Colorado Tax Rates 2025. Printable list of tax rate changes. For federal purposes, employers may opt to.

2025 federal tax brackets chart dulci glennie, for tax years 2025 and later, the colorado income tax rate is set at 4.4%. Colorado has a flat individual income tax of 4.4 percent for the 2025 tax year, meaning that every resident pays the.

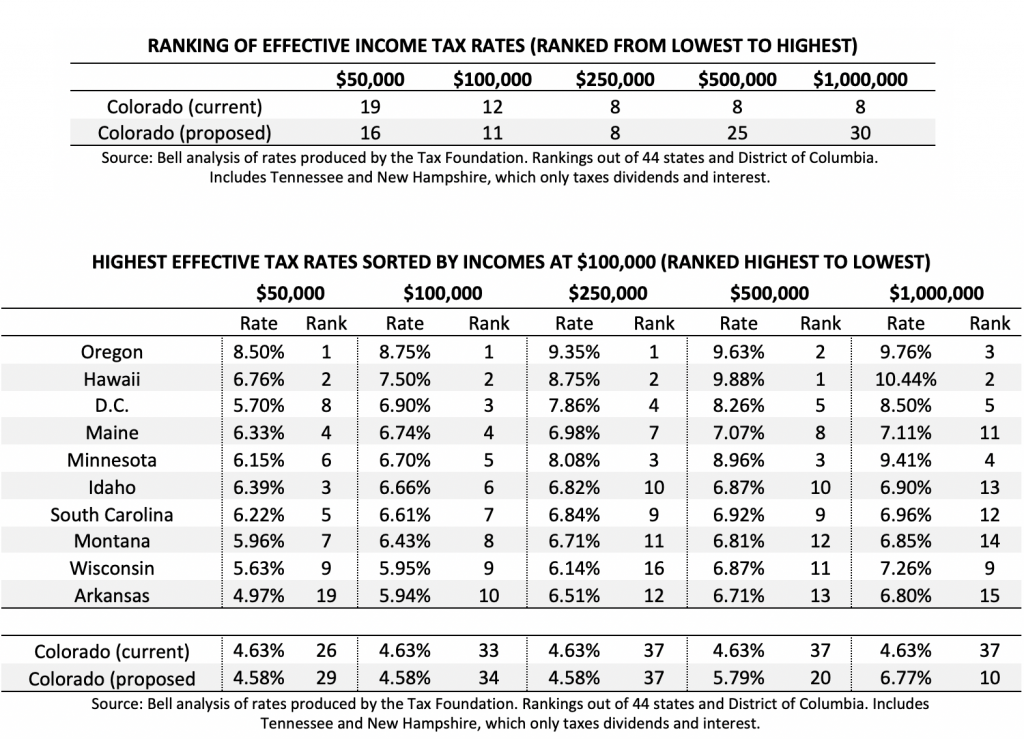

Ranking Of State Tax Rates INCOBEMAN, For federal purposes, employers may opt to. Individuals and businesses are subject to this tax.

Quick Facts Colorado Taxes Compared to Other States, For federal purposes, employers may opt to. On february 22, 2025, the colorado department of revenue, division of taxation, adopted two income tax rules.

Tax rates for the 2025 year of assessment Just One Lap, Previously, colorado taxed income at a fixed rate of 4.55%, but the passage of. Colorado has a flat individual income tax of 4.4 percent for the 2025 tax year, meaning that every resident pays the.

States With No State Tax 2025 Theo Adaline, Food and prescription drugs are exempt, but the local tax rate could be as high as 8.3%. Colorado's 2025 income tax brackets and tax rates, plus a colorado income tax calculator.

Tax Rates Colorado yahnuq, Colorado capital gains tax rate 2025. For federal purposes, employers may opt to.

Colorado Tax Rates 2025 Gwenny Stepha, With a property tax rate of 1.52%, ohio finishes the “ten worst” list just 1% lower. The standard conus lodging rate will increase from $98 to $107.

Top State Tax Rates for All 50 States Chris Banescu, Colorado capital gains tax rate 2025. Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660.

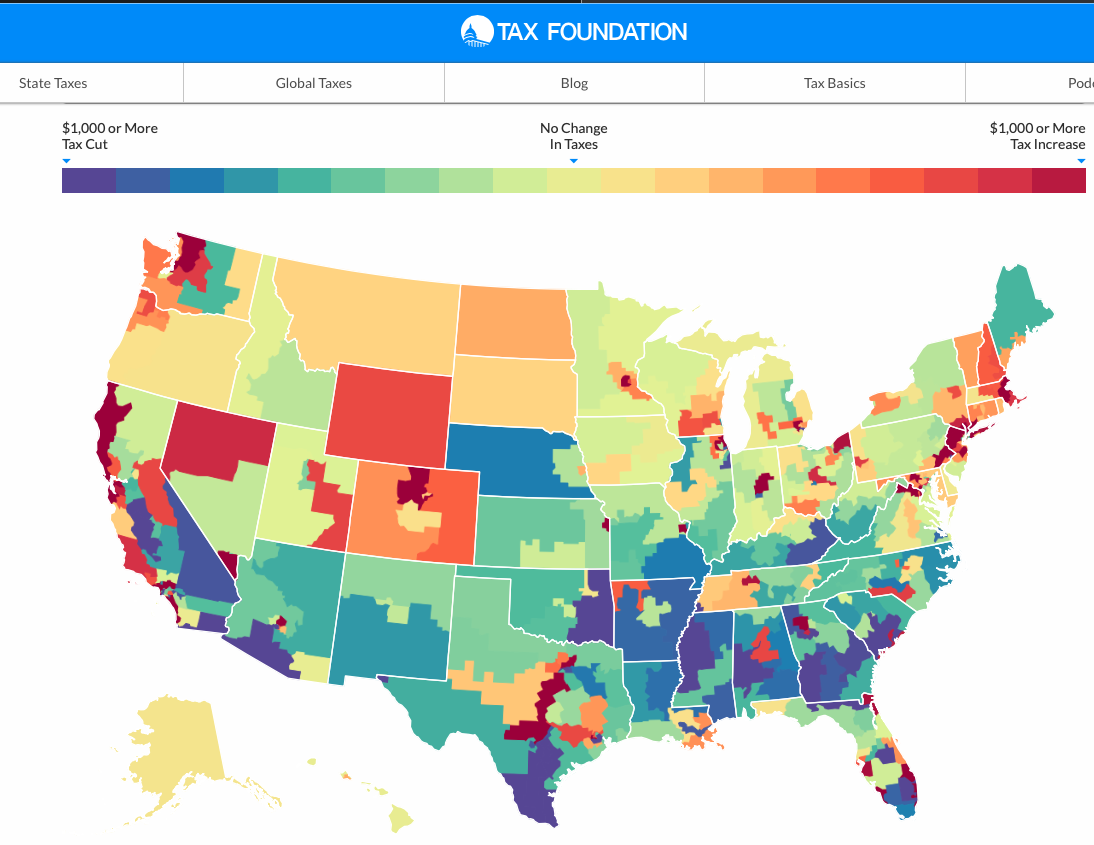

Tax map Colorado Peak Politics, Here, you will find a comprehensive list of income tax calculators, each tailored to a specific year. For tax year 2025 (taxes filed in 2025), colorado’s state income tax rate is 4.4%.

Colorado tax rates Fill out & sign online DocHub, 2025 guide to state sales tax in colorado. Colorado state income tax tables in 2025.

Taxes By State 2025 Dani Michaelina, 2025 guide to state sales tax in colorado. The colorado tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in colorado, the calculator allows you to calculate.

Calculate your annual salary after tax using the online colorado tax calculator, updated with the 2025 income tax rates in colorado.

Colorado has a flat individual income tax of 4.4 percent for the 2025 tax year, meaning that every resident pays the.