How To File Exempt On W4 2025 Example. You can be exempt from income tax withholding only if you expect to not have tax liability for 2025. To qualify for exempt status, an employee must not have had.

You still need to complete steps 1 and 5. This applies whether you claimed exempt withholding status in 2025 or not.

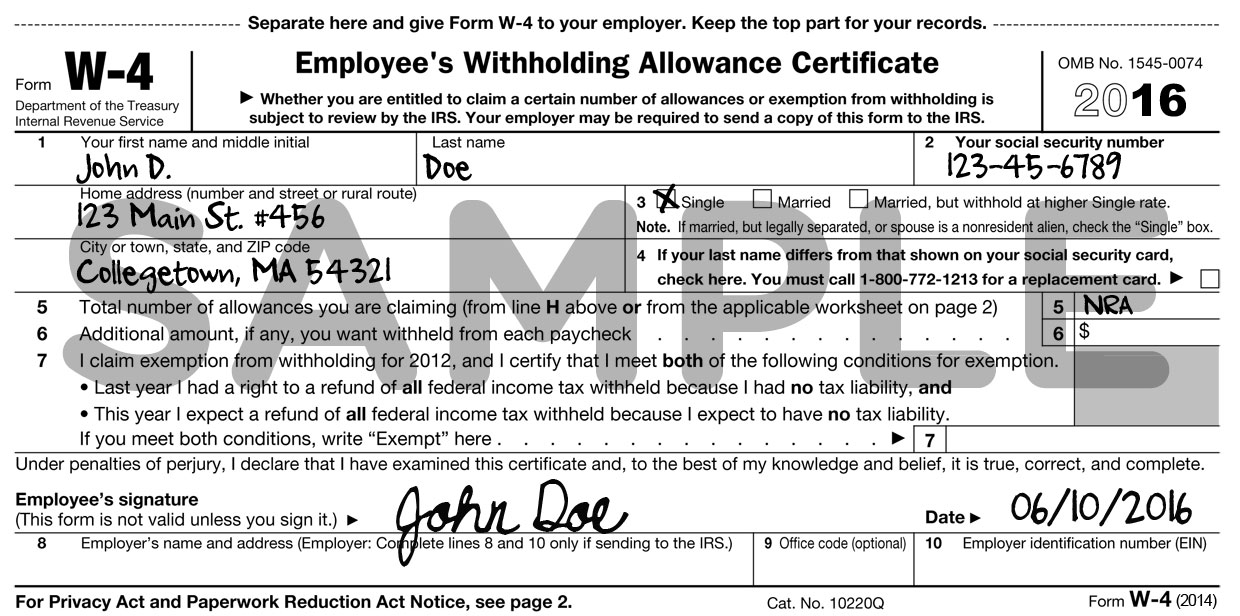

Explain Exemptions On W 4 Form, All you need to do is fill out step 1(a), step 1(b), and step 5 of the form and write exempt in the space under step 4(c).

3 Ways to File As Exempt on a W4 wikiHow Life, This applies whether you claimed exempt withholding status in 2025 or not.

W4 Form 2025 Fillable Form Steven Hill, If you claim exempt, this means no taxes will be taken out of your paycheck during the year to compensate what you may.

W4 Exemption In Taxes Tax rules, Tax, Tax preparation, On the 2025 edition of form w4, claiming exempt status is fairly easy.

Can I file exempt on the IRS Form W4? Tax Withholding Exempt, On the 2025 edition of form w4, claiming exempt status is fairly easy.

W4 Form Exemptions Explained, Before we get to the detailed instructions to file form w4, know how to claim exempt status for tax withholding.

W4 Exemptions 2025 W4 Forms, You can withhold tax for other income this year that won’t have a withholding, including interest, dividends and retirement income.enter the income amount in.

Important Tax Information and Tax Forms · InterExchange, All you need to do is fill out step 1(a), step 1(b), and step 5 of the form and write exempt in the space under step 4(c).

How Are Bonuses Taxed? (with Bonus Calculator) Minafi, To qualify for exempt status, an employee must not have had.